Mergers & Acquisitions

HazMat Due Diligence

Your Partner in HazMat M&A Confidence

At STARS HazMat Consulting, we specialize in guiding mergers and acquisitions through every step of hazardous-materials compliance. From our discreet pre-LOI reviews and in-depth post-LOI audits to targeted remediation after close, our three-phase approach uncovers hidden risks, protects deal value and ensures your new operation runs safely—and profitably—from day one.

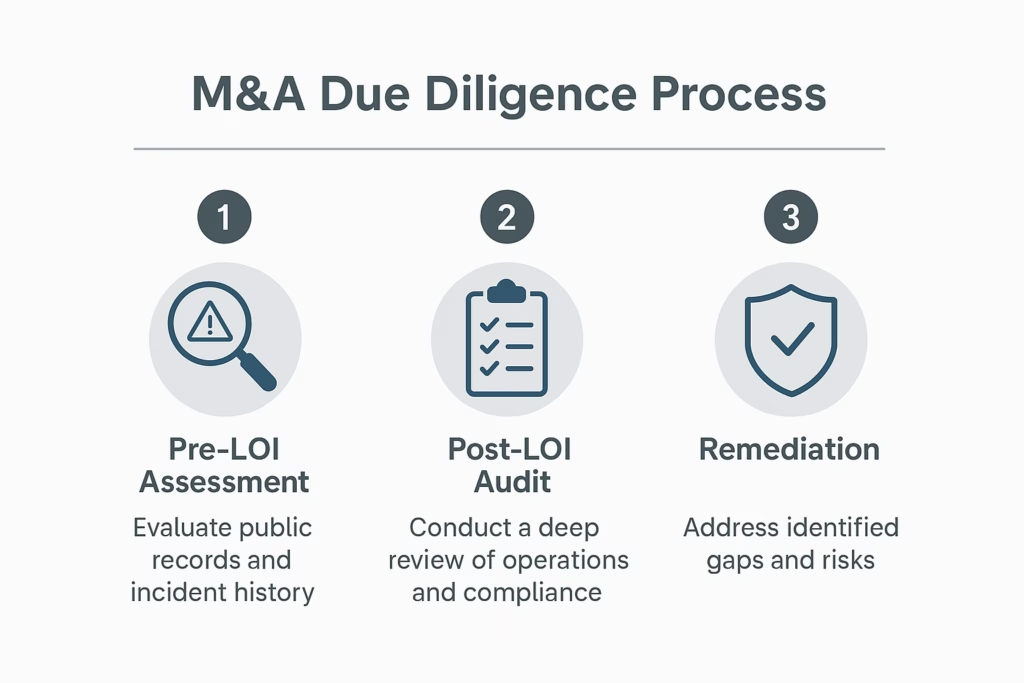

Your HazMat M&A Roadmap

Protect your transactions and unlock confident decision-making with our proven three-phase approach:

1. Confidential Pre-LOI Assessment

Using publicly available data and incident history, we perform a discreet compliance review to flag potential red flags before a letter of intent is signed.

2. Post-LOI Deep Dive Audit

After LOI execution, we conduct an in-depth audit of facility operations, shipping records and regulatory filings to uncover hidden liabilities.

3. Targeted Remediation & Support

Following close, we implement actionable remediation plans—training, policy updates and process improvements—to close gaps swiftly and set your new venture up for safe, profitable operations.

Key benefits you’ll gain:

- Early risk identification to protect deal value

- Actionable insights for seamless transaction flow

- Expert-led remediation for long-term compliance

- Peace of mind with senior-level hazmat expertise

Why Choose STARS?

28+ years of industry experience

Comprehensive knowledge across all transportation modes

Dedicated team of certified professionals

Proven track record of successful implementations

Commitment to excellence and safety

Custom solutions for your specific needs

Your Success Is Our Priority

At STARS HazMat Consulting, we believe that proper hazardous materials management is not just about compliance – it’s about excellence. Our team works alongside yours to develop and implement solutions that protect your workers, the public, the environment, and your bottom line.